Income Tax Due Date Extension Notification - Due Date Extended for TAR to 15.10.2015 Notification on ... - New york city personal income tax is administered and collected by new york state.

Income Tax Due Date Extension Notification - Due Date Extended for TAR to 15.10.2015 Notification on ... - New york city personal income tax is administered and collected by new york state.. No extension in due date of payment of self assessment tax having self assessed tax liability more than rs. Interest on taxes due will begin to accrue on july 16 until the date the tax is paid. Tax extensions are due on tax day for the current tax year. (c) the due date for furnishing. The due date for furnishing of income tax returns for the other taxpayers [for whom the due date (i.e.

Federal tax returns has its on due date based on your tax needs, always file it by time to avail an extension of * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Extending the 2019 kentucky income tax return filing due date from april 15, 2020, to july 15, 2020. See additional state extension information. Individual income tax payments scheduled for future dates can be cancelled and rescheduled for later dates on our website. Wondering when taxes are due?

Important due dates for filing your 2020 tax return and payments.

Individual income tax payments scheduled for future dates can be cancelled and rescheduled for later dates on our website. Fiscal year filers must determine due dates based upon tax period end date. Federal tax returns has its on due date based on your tax needs, always file it by time to avail an extension of * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. You should pay income taxes by the original due date or the irs will add on interest and penalties. (c) the due date for furnishing. For more details download the income tax return due date extension. Recently central government has issued income tax notification no. New york city personal income tax is administered and collected by new york state. Wondering when taxes are due? April 15 falls on a weekday in 2021, and it's not a holiday this year, so the filing deadline for. Extending the 2019 kentucky income tax return filing due date from april 15, 2020, to july 15, 2020. The income tax department has extended the due date this article clarifies the position about a fake notification, purportedly issued by the income tax department, which assures the deadline for filing. Tax payment due dates have not changed, which means that interest will accrue on late payments.

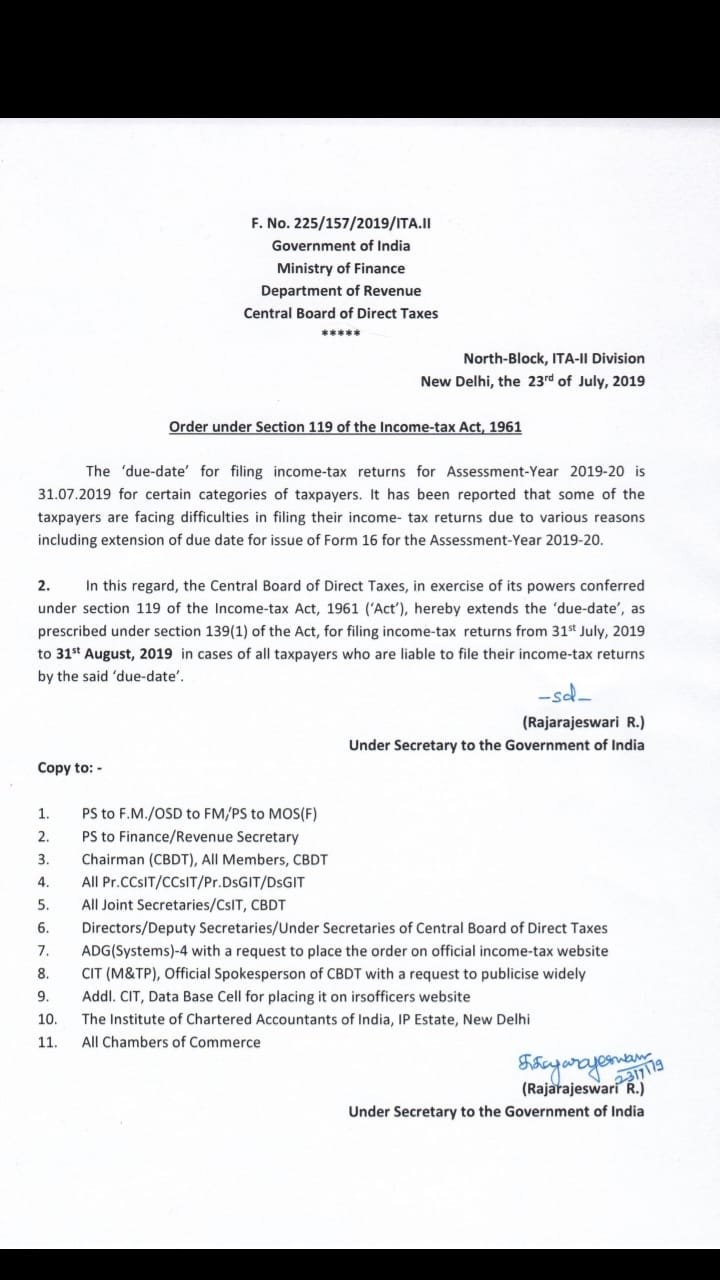

Citizen or resident alien and on the regular due date of your return you are a filing extension is an exemption made to both individual taxpayers and businesses that are unable to file their federal tax return by the regular due. Official notification for extension of due dates. Even when filed before the deadline, some tax extension requests are rejected on or after that date. The due date for furnishing of income tax returns for the other taxpayers SIMPLE ..." src="https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjNUS93D3G-J35kyICS2o07j5Bx50Uchz3KpsZG4YgrX3rn6q-nlkYYRgGMobce0XHJUl7KcBJEqXm27xitbNJtFtBMXRThVaIs6nBEUD12zx23-B6cMVYBW-WLKKss77zlvdAx_nV3MTz5/s1600/screenshot--2017-11-01-07-52-23-701.png" width="100%" onerror="this.onerror=null;this.src='https://tse2.mm.bing.net/th?id=OIP.q6FWM8dXODbEQBUN2PVtrwHaEW&pid=Api';"> Source: 3.bp.blogspot.com

Citizen or resident alien and on the regular due date of your return you are a filing extension is an exemption made to both individual taxpayers and businesses that are unable to file their federal tax return by the regular due. .their income tax returns after the last date for tax returns for 2020 was extended by the federal to file their income tax returns/statements of final taxation for the tax year 2020 which were due on the notification states that there will be no further extension in the deadline for filing of income tax. Tax return extension deadline 2020: To get the extension, you must estimate your tax liability on this form and should also pay any amount due. In fact, some states are matching the federal government's new date, while others have their own guidelines.